Lieutenant Dan got me invested in some kind of fruit company. So then I got a call from him, saying we don’t have to worry about money no more. And I said, that’s good! One less thing.

Anyone who invested in Apple’s first stock offering in 1980 made a very a good move. Buying just one hundred shares (for $2,200) would leave you with a six figure portfolio of Apple stock today.

The current price of Apple stock is around $444, and the stock has been split (diluted) three times since 1980. But Apple’s original computer, the Apple I, is also worth a surprising amount of money. It has become a luxury item, and working models can fetch six figure bids at auction. The New York Times reports:

“The astronomical run-up in the price of the original Apple-1 machines — made in 1976 and priced at $666.66 (about $2,700 in current dollars) — is a story of the economics of scarcity and techno-fetishism, magnified by the mystique surrounding Apple and its founders, as the company has become one of the largest, most profitable corporations in the world.”

Most recently, an Apple I sold in an auction house in Germany for $640,000, beating both its minimum sale price of $116,000 and its estimated sale range of $260,000 to $400,000.

Hearing this we wondered, which was a better investment, Apple’s first stock offering, or the Apple I computer? The answer is the Apple I, by a lot.

Apple stock was recently priced at $443.63. In 1980, its stock was first offered for $22 per share, but adjusting for the fact that the stock split three times, a share cost $2.75. That’s $8.23 in 2013 dollars.

The Apple I sold for $666.66 in 1976, which in 2013 dollars is $2,757.94.

If we calculate the return on investment of each, just looking at change in the share price and the Apple I versus its auction value today, we find that the return on investment of 1 share of Apple stock is 5,290%. The return on investment of the Apple I that sold for $640,000, in contrast, is 23,106%. Even the return on investment of selling the Apple I at the auction house’s minimum sale price of $116,000 is 4,106%!

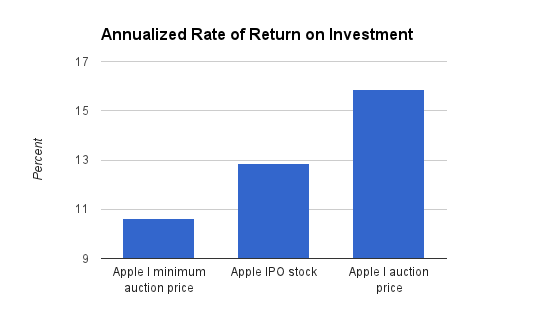

To be more precise, we can adjust for the fact that the Apple I came out 4 years before Apple first publicly sold stock. If we calculate the annualized rate of return (the compound annual growth rate), we get the following.

Of course, the value of both Apple stock and the Apple I are very volatile. Apple stock was priced at $700 in September, and who knows what the next Apple I could go for at auction.

So if there’s a moral to the story, it’s probably not that this is a new investment strategy. It’s just another reminder that people are really crazy about Apple. And that a surprising number of people held onto their first computer for 37 years.

This post was written by Alex Mayyasi. Follow him on Twitter here or Google Plus. To get occasional notifications when we write blog posts, sign up for our email list.