This post is adapted from the blog of Craft, a Priceonomics Data Studio customer. Does your company have interesting data? Become a Priceonomics customer.

***

Silicon Valley – the promised land of innovation, venture capital, and exorbitant costs of living. And many of the most valuable companies from the region, such as Square, Stripe, Airbnb, Uber are all based in the city of San Francisco.

Increasingly, however, it’s hard for startups to compete in the market for talent in the infamously expensive city of San Francisco.

In March 2017, a blog post by Zapier CEO, Wade Foster, announced they would offer a $10,000 “De-Location Package” to employees that would move out of San Francisco. Fintech startup Varo Money announced in July that they plan to move their headquarters from San Francisco to Salt Lake City, citing high home prices among other reasons.

We decided to analyze whether startups based in San Francisco actually had offices elsewhere as well. Are companies located in the city for fundraising and marketing purposes, but also creating offices in other cities and countries? Is this phenomenon limited later stage companies only or are early stage companies saving costs this way too?

We took a look at the startups headquartered in San Francisco to determine if and when they expand to locations in other regions and where those regions are. Specifically, we pulled data on the 903 companies headquartered in San Francisco that have more than $5 million in funding from our Craft dataset of companies and their locations.

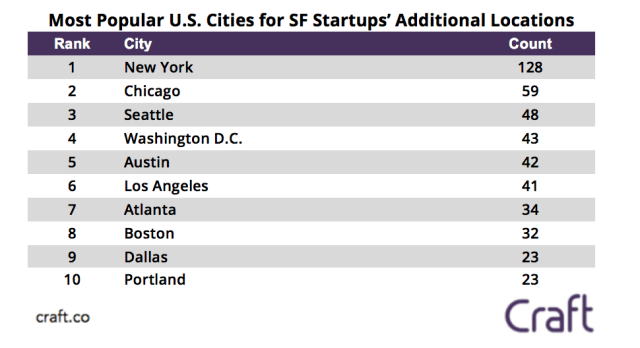

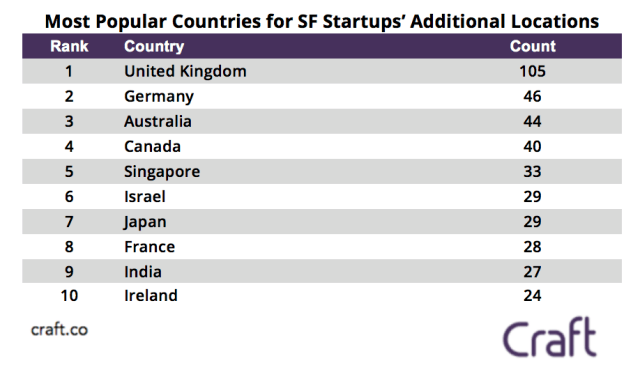

We found that 38% of San Francisco tech companies companies had locations elsewhere – with New York as the top U.S. city for an additional location and the U.K. as the top country for an additional location. Even for early stage startups (defined as raising $5-10MM in this analysis), 21% of San Francisco companies also had offices elsewhere.

***

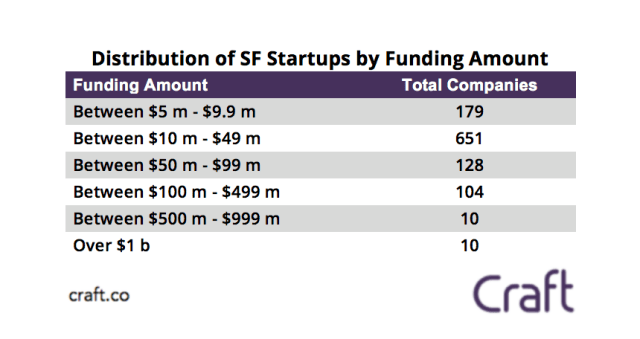

For context, the table below shows the distribution of these startups in buckets based on total funding that we will use for this analysis.

As one might expect, there are far more startups in SF with less than $50 million in funding than there are those with more than $500 million in funding. While many startups aspire to be the next Uber or Airbnb, the distribution is heavily skewed towards those with lower amounts of funding.

Data source: Craft

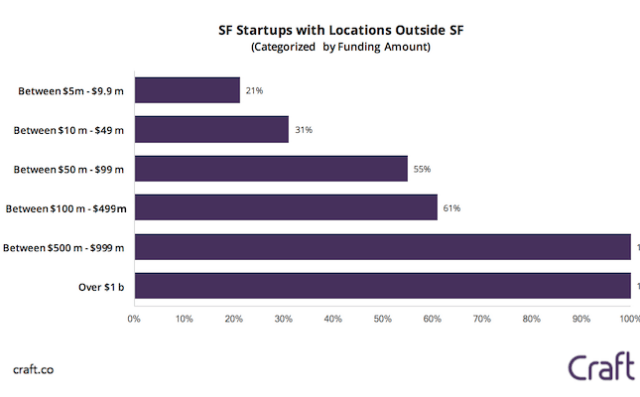

To begin, we analyzed the distribution of companies that have solely their San Francisco location and those that have office locations outside of San Francisco. Of the 903 companies that fit our criteria, 339 startups (roughly 38%) have locations outside of San Francisco, which means that 564 of companies only have their primary SF office. See the companies with locations outside of San Francisco here.

We then categorized companies by funding amount to see if there is a relationship between the amount of funding a startup has received and whether they have expanded to office locations outside of San Francisco. Our hypothesis was that companies with more funding have more capabilities to expand into new and potentially lower cost locations but we wanted to see if smaller, earlier-stage companies also had offices elsewhere. The graphical display of these two distributions clearly show that as the funding amount increases, the percentage of companies that have office locations outside of San Francisco increases, while the inverse (companies with only their San Francisco location) decreases.

Data source: Craft

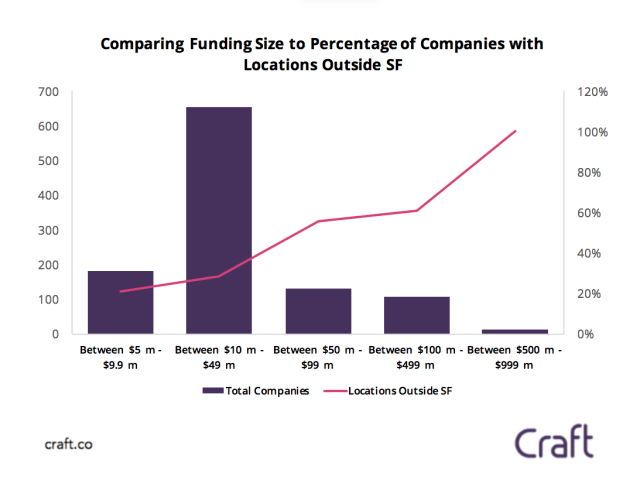

The graph below shows a clear trend that companies with higher amounts of funding have locations outside of their primary headquarters in San Francisco. As companies grow, they definitely have offices outside of San Francisco but it’s important to note here that even a significant portion of smaller companies have locations elsewhere.

Data source: Craft

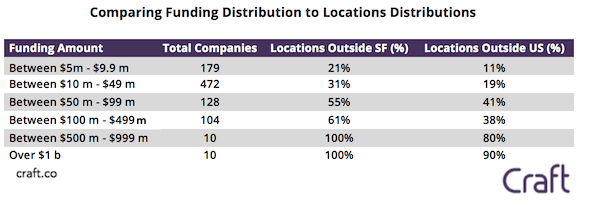

Taking the analysis one step deeper, we also took a look at the percentage of companies with locations outside the United States, in addition to those with locations just outside of San Francisco. Out of the 903 startups in our dataset, there are 219 (roughly 24%) of companies with locations outside of the US, compared to 38% that just have locations outside of San Francisco.

Data source: Craft

Next, we analyzed what the top cities in the United States where these companies have additional locations. The table below shows the top 10 cities where startups headquartered in San Francisco have additional locations. New York tops the list with 128 companies that have New York locations.

Data source: Craft

Finally, we did a similar analysis to see what countries are most popular for startups to have additional locations. The table below shows the top 10 countries where startups headquartered in San Francisco have expanded to for international office locations. The U.K. tops the list with 105 companies from our dataset that have international United Kingdom locations, which represents roughly 48% of our subset of companies that have international locations. Also of note is that three of the top four countries are English-speaking countries.

Data source: Craft

Key takeaways:

-

38% of startups headquartered in San Francisco with more than $5 million in funding have an additional location outside of San Francisco

-

Companies with higher amounts of funding have, in general, office locations outside of their primary headquarters in San Francisco; however, a significant portion of smaller companies have locations elsewhere, as well.

-

The most popular US city for SF startups to have an additional location is in New York City. The most popular country for SF startups to have an additional international location is the United Kingdom.

***

Note: If you’re a company that wants to work with Priceonomics to turn your data into great stories, learn more about the Priceonomics Data Studio.