This article is a joint production with NPR’s Planet Money. You can find their radio story on the Planet Money website or wherever you get your podcasts.

***

Imagine if you had to pay your credit card bill the way you pay your taxes.

Each month, Visa would send you a blank form. The form would instruct you to gather all your receipts, write down every purchase you had made, and calculate the total amount you owed Visa.

After you sent in your bill, Visa would check its records. If you’d forgotten a receipt and underpaid, Visa would fine you. If you’d made a big enough mistake, you’d go to jail.

This is how Joe Bankman, a professor of tax law at Stanford University, explains the absurdity of paying taxes in America. “If Visa sent you a blank piece of paper each month instead of a bill,” he explains, “you’d say, ‘This is crazy.’ ”

After all, when your employer, bank, or financial manager sends you information about your salary and income, they send it to the government too. The government uses that information during audits. But it could also fill out everyone’s tax forms and calculate their tax bill.

The name for tax filing where the government sends out completed tax forms is return-free filing or pro forma returns. Countries like Sweden and Spain use return-free filing. In Estonia, 95% of taxpayers receive their tax bill online, and many pay with a single click.

The United States is one of the few countries—and the only wealthy country—that forces taxpayers to gather up tax forms and calculate their own bill. The reason why is a uniquely American mix of lobbying by tax preparation companies—who worry about demand for their services—and anti-government sentiment.

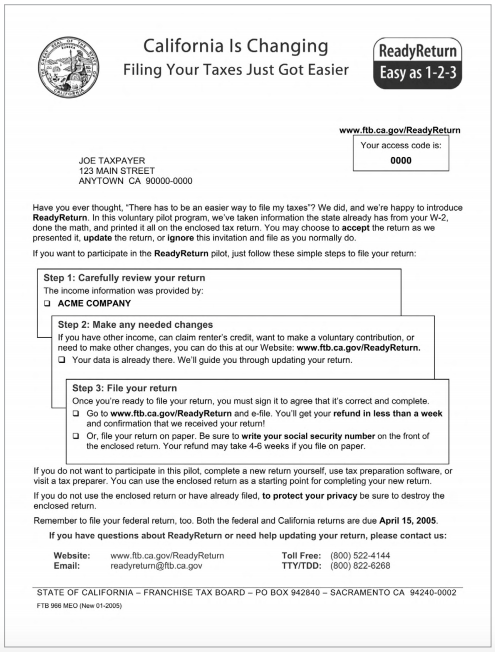

There is one program in America, however, that provides some taxpayers with completed tax returns. Since 2007, around 80,000 California taxpayers each year have paid state income taxes this way under a program called ReadyReturn.

ReadyReturn survived corporate lobbying for one reason: Joe Bankman decided to make easy tax filing his personal mission, and he spent $30,000 to hire a lobbyist to counter lobbying by Intuit, the maker of TurboTax software.

“I can’t cure cancer,” says Bankman. “But I can help simplify tax filing.”

ReadyReturn’s existence proves that the government can make it easier to pay taxes. If tax filing in America ever becomes as easy as in the rest of the world, we’ll all be indebted to a selfless professor who loves taxes.

Better than the Polio Vaccine

Joe Bankman is an academic through and through. During our interview, he explained that tax policy is fascinating because it’s “thinking about what kind of government you want.” Like any good academic, he had a chalk stain on his khakis.

But in the early 2000s, Bankman developed a unique reputation as an ivory tower professor who could navigate the scrum of politics. Bankman is an expert on tax shelters, and in 2003, he helped Californian lawmakers write legislation that identified people using illegal tax shelters. The law offered them amnesty if they paid back taxes. Within a year, the treasury received one billion dollars. It was the largest tax amnesty program in U.S. history—at a time when a budget crisis forced California to cut funding for schools, colleges, and police departments.

In 2004, staffers from California’s tax agency, the Franchise Tax Board (FTB), told Bankman they had this other idea: They realized they had all the data they needed to fill out Californians’ tax returns for them. Or at least for millions of Californians whose entire income came from one job. But when they launched a website to make tax filing easier, Intuit sued and lobbied California legislators to kill the idea.

Bankman was skeptical. “Conventional wisdom said you couldn’t do it,” he says. “Unlike in other countries, the U.S. tax code is just too complicated.” In 1998, Congress had demanded the IRS consider return-free filing. The IRS concluded that—unless the tax code was simplified—return-free filing would just shift the burden to the IRS and businesses without saving time or money. So Bankman asked the FTB employees to send him proof.

“I couldn’t believe it when I got it,” says Bankman. “They’d already solved the problems… I had a sabbatical coming up, so I said, ‘Let me get involved.’ ”

Bankman saw the stakes as bigger than California. Since California’s tax forms match federal tax returns, they could prove that return-free filing would work nationwide.

More importantly, Bankman saw it as an effort to change how Americans view their government.

“Filing taxes is one of the most important interactions you’ve got with your government. How do you feel about government if [doing your taxes] makes you feel pissed?” he says. “So changing that would affect the way we think about government and our joint undertakings. It would show that government cares about you.”

Over meetings and emails, Bankman worked with the FTB to develop a pilot program called ReadyReturn. It would offer 50,000 low income Californians the opportunity to receive completed tax returns. Like a credit card bill, they could check it if they wanted, or pay right away.

Bankman then asked the FTB’s board to approve the plan, and his status was key. One board member, Tom Campbell, had been a law professor with Bankman at Stanford. The FTB chair, Steve Westly, was an early eBay employee turned Controller of California. He knew Bankman from Stanford too, and he liked Bankman’s pitch that the pilot would make California a national leader in using technology.

On the day the Franchise Tax Board publicly voted on the pilot, an army of lobbyists and executives representing Intuit, H&R Block, and other tax preparers condemned the idea. They said tax bureaucrats were trying to unfairly compete with the private sector. Bankman sat with FTB staffers, who weren’t optimistic. But the board voted for the pilot.

Bankman viewed this as a victory, but he didn’t know whether the pilot would succeed. “I figured, how useful can it be if you still have to do your federal taxes?” he says.

When the results came in, he was shocked. Around 11,000 out of 50,000 Californians chose to use ReadyReturn, and they loved it. “Wow! Government doing something to make life easier for a change,” one taxpayer wrote in response to a ReadyReturn survey. “I wish that I could do my federal taxes the same way,” wrote another. On average, taxpayers saved around $30 and 30 minutes. The state saved money too, because more people filed electronically, and they made fewer errors. The FTB asked taxpayers how satisfied they were with the program, and 98% chose satisfied or very satisfied.

“You don’t get that good reviews with government programs,” says Steve Westly. “The polio vaccine doesn’t get a 98% satisfaction rate.”

“I thought we’d won,” says Bankman. “Now that we knew we could do this, we’d do it for everyone in California, and people in Washington could copy it.” Wealthy people would still have to fill out parts of their returns, and federal taxes came with a few complications: people would still need to list their charitable donations to get a deduction. But filing taxes would be simpler, and Bankman felt he’d done his part to make people “a little less pissed at the government.”

A few days later, a legislator called Bankman to tell him that Intuit’s lobbyists had killed ReadyReturn.

Mr. Bankman Goes to Sacramento

When the pilot finished, California legislators were overdue in passing a budget. State employees were going unpaid. So when a legislator sympathetic to Intuit put language in the budget that denied funding for ReadyReturn, few legislators noticed, and none wanted to hold up the budget over some little program.

“I was kind of devastated,” says Bankman. “I thought, are the kooks right? Are we owned by companies?”

But he quickly rallied. ReadyReturn had sterling reviews, and Bankman had time during his sabbatical to explain the program to all 120 members of the California legislature.

“I’m a professor, that’s what I do,” he says. “I talk. I’m a talker.” He felt sure they’d vote ReadyReturn back into existence.

Bankman had worked with a prominent California legislator, Dario Frommer, and his chief of staff, Dan Reeves, on the tax shelter law. He met with them, and Frommer agreed to sponsor a bill that rolled out ReadyReturn statewide. Steve Westly, the chair of the FTB and State Controller, talked to Governor Schwarzenegger. He says the Governator thought ReadyReturn was a “slam dunk.”

But momentum quickly stalled. On his next trip to Sacramento, Bankman drove the 120 miles only to be stood up by a legislator. Often he would make five calls to a representative’s office and only get a meaningless meeting with an aide—or no response. After a month, he’d only met 10 legislators.

During one meeting with his Sacramento allies, Bankman asked, “Would it help if I had a lobbyist?”

“They looked at me like the answer was of course yes,” says Bankman. “They were embarrassed to admit it.” But he persisted, and they sent him some names. Soon enough, Bankman had hired his very own lobbyist, Mike Robson, for $30,000.

How did his family feel about spending $30,000 on a personal lobbyist? “They were absolutely supportive,” says Bankman. The family had saved the money to remodel their kitchen. Instead of a kitchen remodel, they paid for the only lobbyist in favor of simpler tax returns.

Bankman didn’t feel great about their first appointment. “We were meeting a good government [politician],” says Bankman. “I was a little embarrassed to have a lobbyist with me. It was like bringing a prostitute to the ball.”

He quickly realized that legislators felt differently. The legislator knew Robson and seemed reassured by his presence. After the meeting, Robson suggested they drop into another politician’s office. As they walked over, Bankman didn’t mention that he’d left that legislator multiple voicemails. To his surprise, when Robson asked the receptionist to “squeeze them in,” she scheduled a meeting for an hour later.

He noticed a lot of people on a first name basis with the receptionist scheduling meetings. When he asked who they were, Robson responded, “lobbyists.”

This experience could have depressed Bankman—a lobbyist was clearly the price of admission. “I don’t want to say this wrong,” says Robson. “But you want to be taken seriously, and a lobbying firm does give you legitimacy. It shows you’re a real entity.”

But Bankman raves about lobbyists. “They’re great guys,” he exclaims. “I kind of had the wrong idea about lobbyists. It’s a complicated profession.” From a lawmaker’s perspective, a lobbyist is a colleague who can explain one of the thousands of bills they vote on. Robson’s firm even gave Bankman a discount because they thought his idea was good public policy.

With Robson’s help, their vote tally inched toward the 41 out of 80 they needed in the State Assembly (California’s version of the House of Representatives). Bankman would brave three hours of Bay Area traffic, meet up to five politicians in Sacramento, and spend the night in a motel. The FTB and Frommer’s staff talked to legislators, too, and to journalists who wrote op-eds describing ReadyReturn as a “no-brainer.”

But then, Frommer says, “We ran into a wall. And the wall was Intuit.”

TurboTax software on display in a store. Photo by Mike Mozart

According to the L.A. Times, Intuit spent $1.25 million on lobbyists and gave $2.12 million to 120 California politicians from 2005 to 2010. Bankman says Intuit’s influence was obvious. In one meeting, he says, the legislator told him, “I’ve been warned about you.”

“What Intuit did well was they created a boogieman,” says Dario Frommer. “They said ReadyReturn would put all these accountants out of business, and they organized African-American and Latino accountants against the bill.”

(Frommer and Bankman say this is misleading, since people with enough money to pay an accountant would still appreciate that accountant’s help to claim deductions.)

Intuit also found an unlikely ally: Grover Norquist, the conservative political activist who convinced hundreds of Republicans in Congress to pledge never to raise taxes—and who memorably said that he wants to shrink government “down to the size where we can drown it in the bathtub.”

In 2005-2006, a task force assembled by President Bush to work on tax reform considered return-free filing. “Norquist quickly realized this was a big deal,” says Bankman. Norquist and Bankman faced off at Washington panels, in dueling op-eds, and on a joint NBC News appearance. Norquist’s argument was that letting the IRS “do your taxes” was a conflict of interest—the IRS wanted to overcharge people.

Although Intuit is located in liberal Silicon Valley, their executives and lobbyists made the same argument. On the day of the ReadyReturn vote, tax prep companies paid for a full-page ad in the Sacramento Bee. It had a picture of a bulldog with a steak in its mouth. It read:

Would you send him to the butcher to pick up your steak? Of course not! So why would you let bureaucrats in Sacramento fill out your taxes?

That morning, Frommer polled his colleagues in the Assembly and found they were a vote short. No Republicans would vote for the bill, and some Democrats would vote ‘no’ too.

Once again, Intuit had blocked ReadyReturn.

Mr. Smith Goes to Washington

Even in death, the ReadyReturn pilot still proved the government could simplify tax filing.

In late 2006, Austan Goolsbee, a prominent economist and Obama advisor, wrote a white paper about return-free filing. In the 2008 election, both Obama and John Edwards endorsed the idea.

“I thought we’d won again,” says Bankman. “I spent 2009 in Washington. I thought it would be just working out details.”

Other members of the ReadyReturn team were less naive. “Having been through that fight,” says Dario Frommer, “I’m not surprised that it was not adopted at federal level.”

Grover Norquist made it impossible to win over Republicans, and Bankman faced the same hostile questions from members of Congress who had spoken to Intuit. He was playing catch up. Records show that tax preparers have spent over $28 million lobbying Washington since 1998. In 2007, Eric Cantor (a Republican leader) and Zoe Lofgren (a Democrat from Silicon Valley) had introduced a bill to ban return-free filing. Both received contributions from Inuit.

Bankman believes that Norquist opposes return-free filing because he wants frustrated taxpayers to hate the government. If everyone felt as good about taxes as the users of ReadyReturn, Norquist’s government is the problem rhetoric would take a blow.

In an interview with our NPR partners, Norquist denied this motivation. But the idea has a history among limited government Republicans. When Ronald Reagan was governor of California, he opposed a reform that would make paying taxes more seamless on the grounds that “paying taxes should hurt.”

Either way, one reason America has not followed other countries’ lead in simplifying and modernizing tax returns is the distrust Norquist and his allies feel toward government.

Grover Norquist speaks at CPAC. Photo by Gage Skidmore

Another way to view the ReadyReturn saga is as an example of a tech company behaving badly. The public tends to view all lobbying as morally dubious. But people in this story are adamant that lobbying has value—and that Intuit’s lobbying was out of bounds.

“We respect lobbyists who… play it straight,” says Dario Frommer. But due to tactics like Intuit lobbyists misleading accountants, he says, he ended his friendship with an Intuit lobbyist. “I don’t think she played it straight,” he says. “I think the whole campaign was b.s.”

On the national level, ProPublica has reported that Intuit misled community leaders like a rabbi and a NAACP official into writing op-eds that claimed return-free filing would raise taxes on the poor. Bankman is clear that he respected other tax prep companies, like H&R Block, that opposed ReadyReturn honestly.

Intuit declined to be interviewed for this article. In a statement, spokesperson Julie Miller wrote that Intuit opposes return-free filing because it “minimizes the taxpayers’ engagement.” Collecting paperwork and filling out forms does make Americans more aware of their taxes. But the argument is undercut by how many taxpayers avoid the process by hiring accountants.

Miller’s statement also exhibits bad faith. “Public participation in Ready Return was minimal,” she writes. She doesn’t mention that Intuit fought to keep participation low.

It’s always hard to get tax policy right, though, for the simple reason that it is boring. If oil companies lobby for weaker environmental protections, the Sierra Club speaks up. But there’s no equivalent of the Sierra Club or ACLU for tax policy.

“As a result,” says Bankman, “we get a worse tax code.”

The exception is when a tax expert from Stanford spends $30,000 and devotes a year of his life to a good idea. Because, in the end, Bankman won. Sort of.

***

After the ReadyReturn bill failed, Dario Frommer asked a government lawyer whether the state tax agency (the FTB) could roll out ReadyReturn on its own. The lawyer said the FTB could.

So, in 2006, the FTB voted to roll out ReadyReturn. It was a bold move. Intuit had just given $1 million to a Republican running to unseat John Chiang, an FTB member who supported ReadyReturn. The chair of the FTB, Steve Westly, says the support drummed up by Bankman gave them more political space to vote for a program they felt strongly about.

That said, the rollout was timid. Rather than mailing everyone in California a completed tax form, the FTB created an opt-in website, with a limited marketing budget, for around one million eligible taxpayers. The taxpayers were low income, which meant that the state had complete tax information on them, and that they weren’t potential TurboTax users. The FTB later increased the pool to two million eligible taxpayers. According to Bankman and others, this moderation was meant to avoid incurring opposition from the tax prep industry.

Intuit still tried to kill ReadyReturn. But this time, Dario Frommer says, ReadyReturn had enough support in the legislature to block Intuit. In 2013, 99% of its 80,000 users said they were satisfied with ReadyReturn. ReadyReturn was later incorporated into CalFile, which allows Californians to e-file their taxes. Intuit is not a fan.

Photo credit: http://401kcalculator.org

Bankman went to a lot of trouble to make taxes easier for those 80,000 Californians. But he has no regrets. “I felt lucky to be able to do it,” he says. “How many of us have the chance? I felt lucky to even come close to making some change.”

And Bankman may still triumph in the end. Every few years, someone picks up the idea at the federal level, citing ReadyReturn as an example. Most recently, Elizabeth Warren and Bernie Sanders sponsored a bill, which Hillary Clinton endorsed as a presidential candidate.

“Sooner or later,” says Bankman, “I think it’s going to happen.”

When I ask Bankman if we should be alarmed at what it takes to pass “no-brainer” tax policy, he smiles and sees the glass as half full.

“Tax policy is an underrepresented field,” he says. “So it’s a great opportunity for a do-gooder.”

Republicans in Congress want to fundamentally reform America’s tax code this year. Bankman’s experience suggests that the public needs a champion to make sure special interests don’t dictate the outcome.

Anyone looking to do some good might want to start researching tax policy and hire a good lobbyist.

***

Special thanks to Sandy Nader for editing assistance, to Stacey Vanek Smith of NPR for co-reporting this story, and to the Planet Money team for their feedback. Photo credit on top image: KQED News

You can find Planet Money’s radio story about Joe Bankman on the Planet Money website or wherever you get your podcasts.