Source: Derek K.Miller (Flickr)

Two years ago, I was sitting in a stiff armchair on the 14th floor of UCSF Medical Center shaving my father’s head. It was ritualistic: he’d always been proud of his hair, and when it began to come out in clumps on his pillow, he decided he’d take control. Together, we wept as the black curls fell to the floor. He’d just been diagnosed with Multiple Myeloma, a cancer affecting the bone marrow, and was about to go through a high-risk blood transfusion. In the following weeks, I watched him wither away. His trademark energy and excitement were replaced by the rhythmic chirp of an EKG; he struggled to choke down a spoonful of applesauce.

While the experience was devastating, I soon learned to be grateful. As an educator, my father has excellent health care and his HMO covered nearly all of his cancer treatment: blood transfusions, hospital stays, and mountains of pills. At virtually no financial cost, he took advantage of one of the world’s most renowned cancer units and willed himself through chemo. Today, he’s got a full head of hair and he’s back teaching high school drama. He pays $30 per month for a cocktail of “cancer” pills: Revlimid, Dexamethasone, Velcade. Other than that, it’s almost as if the cancer never happened.

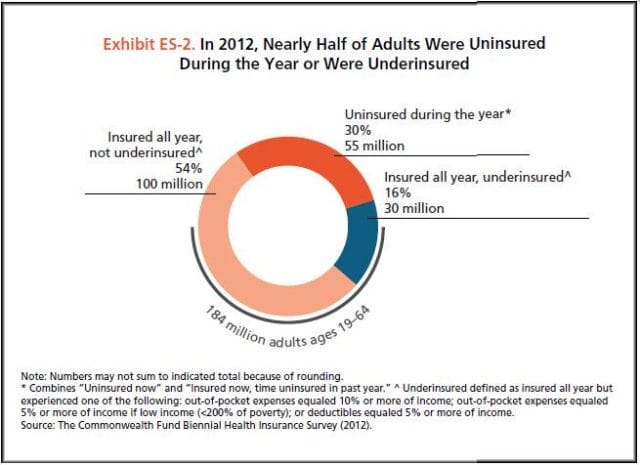

Comparatively, few are as fortunate. The Commonwealth Fund’s Biennial Health Insurance Survey found that 55 million American adults are uninsured; another 30 million are underinsured and experience out-of-pocket expenses that amount to more than 10% of their income. Altogether, nearly half of Americans aged 19-64 have inadequate health coverage.

Source: Commonwealth Fund

For the underinsured, cancer is more than a health dilemma. Unable to afford $100,000 per year cancer drugs and other out-of-pocket expenses, uninsured/underinsured Americans are often presented a choice: face bankruptcy and impossible debts, or forego treatment altogether. Sometimes, the end result is both. Even patients with decent health plans face unreachable copayments.

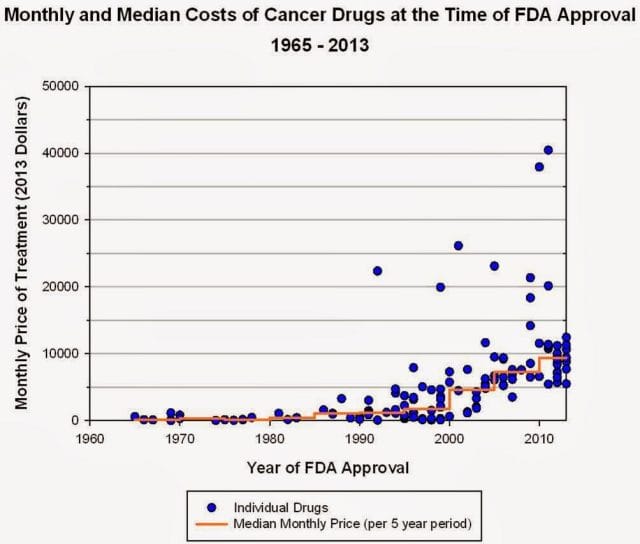

The Affordable Care Act is making an effort to address healthcare disparities, but the list prices of common treatments have continued to soar. In fact, in the last decade, cancer drugs have doubled in average price, from $5,000 to $10,000 per month. What are the root causes behind this?

Cancer at a Glance

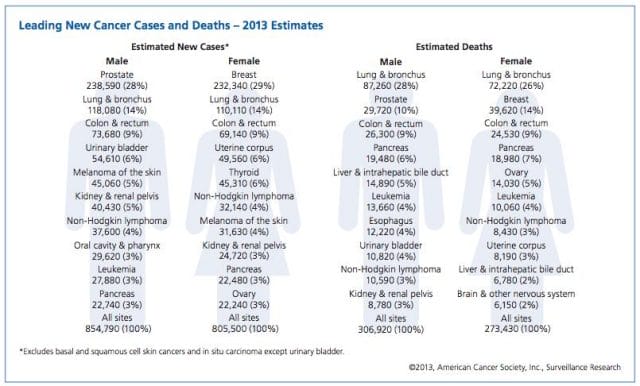

This year, over 1,660,000 men and women will be diagnosed with cancer in the United States. That’s 4,550 new cases each day, or one every 20 seconds. Another 580,350 will die, making cancer the second most common cause of death in America, after heart disease. The top ten most prevalent cancers alone are to blame for 362,000 of these deaths, with lung cancer accounting for 27% of all U.S. cancer deaths.

Source: American Cancer Society

In a 2008 study, The National Institutes of Health (NIH) estimated that the cumulative cost of cancer in the U.S. is $201.5 billion: “$77.4 billion for direct medical costs (total of all health expenditures) and $124 billion for indirect mortality costs (cost of productivity lost due to premature death).”

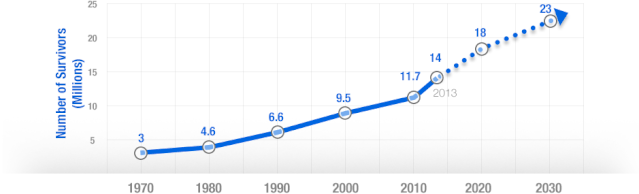

There is some good news about cancer: forty years ago, the average five-year survival rate was 49% — now it’s 68%. Targeted cancer approaches and medical innovations are going through something of a renaissance: last year there were a record 500 potential cancer drugs under review by the FDA, five times as many as the next disease’s drug pool. The costs of genetic sequencing are plummeting, and researchers are getting a better grasp on how to recruit the human immune system to fight the disease.

Cancer Survivors in the U.S. (millions)

Source: VOI

Why Are Cancer Drugs So Expensive?

In 2012, something unprecedented happened. Zaltrap, an advanced colorectal cancer medication, was released by a major pharmaceutical company for $11,000 per month. For this price tag, it offered an average of 1.4 months of extra life compared to existing drugs. At the time, there was another drug, Avastin, which provided identical benefits for half the price. All was looking well for Zaltrap and it’s parent pharmaceutical company, Regeneron, was poised to make huge profits. Then, three doctors said “hell no.”

The doctors, who’d witnessed years of “pharmaceutical abuse,” took to the media and declared an ultimatum: they were not going to distribute this drug to their patients, and encouraged the rest of the medical community to stand up for morality. They cited an uncomfortable trend in cancer drugs:

“The typical new cancer drug coming on the market a decade ago cost about $4,500 per month (in 2012 dollars); since 2010, the median price has been around $10,000. Two of the new cancer drugs cost more than $35,000 each per month of treatment.”

Source: Health Beat

They went on a rampage in a New York Times article, citing that 11 of the 12 cancer drugs approved by the FDA in 2012 cost over $100,000. Ignoring these costs, they said, was “no longer tenable.” Something had to be done. People listened, and within months, Regeneron caved and cut Zaltrap’s price in half.

Despite much outcry, pharmaceutical companies have historically enjoyed the benefit of setting high drug prices because they can. By nature, their product has an advantage: the demand for cancer drugs is “price inelastic,” that is, increases in price don’t reduce a drug’s use. In addition, the brunt of these drugs’ prices is absorbed by a third party: insurance companies.

Nearly every big pharma company in the last decade has cited The price of innovation: new estimates of drug development costs, a 2003 Duke University study, to justify high drug costs. The study, which randomly selected 68 drugs from 10 pharmaceutical firms, found that the average cost to bring a drug to market was $802 million ($1.04 billion in 2013 dollars). Note that while this figure accounts for research and development, clinical trials, FDA approval, and all others facets of the drug production process, it does not account for the considerable amount of time invested in drugs that eventually fail (we’ll get to this in a bit).

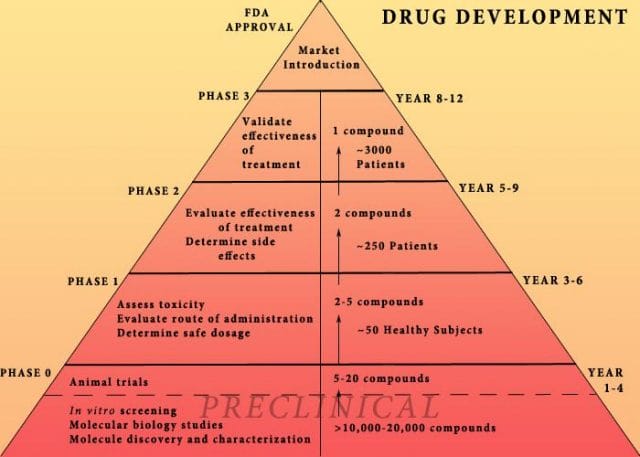

The study cites increasing research and development (R&D) costs and elongated clinical trials processes. In reality, this process is arduous: preclinical research can take up to 3.5 years, and drug applications, clinical trials, and FDA approval can take up to a decade to achieve. In all, from research to market, the average cancer drug takes 12 years — and that’s if the drug is lucky enough to make it (the pyramid below elaborates on each stage of drug development).

Source: Digital Union

Only 10% of drugs in the preclinical testing phase pass on to human testing; from here, only one in five makes it further. When a drug manages to get through this entire process, it only has a 30 percent chance of making a good return, the report adds.

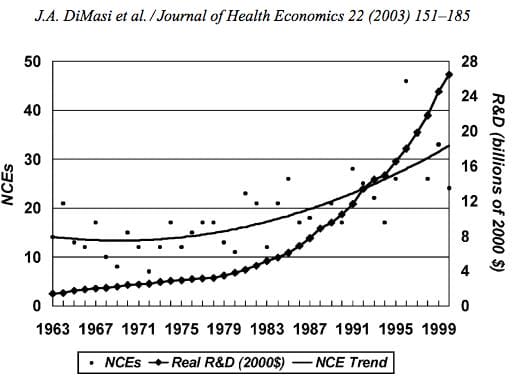

Increasing Costs of Research and Development for Pharmaceutical Companies

Source: Duke University

So what exactly are “research and development” costs? Ashutosh Jogalekar, a drug researcher, tells us to keep in mind that “the science of drug discovery is hard.” Finding an approach to a drug, he says, “is like being asked to find a black cat in the dark, with the added constraint that one of your feet is bound to the top of your head, and you only get three tries.” For the scientifically inclined, it is difficult to determine which proteins are involved in a disease, and even if they find them, there is no guarantee these proteins can be bound into a “small molecule drug.” A major factor contributing to high drug costs, then, is the fact that 95% of drugs fail; pharmaceutical companies have to cover their ground.

However, expert critics claim these companies cover much more ground than is necessary. In his book, The $800 Pill: The truth behind the cost of new drugs, journalist Merrill Goozner closely analyzes the creation of major drugs, and finds “almost all drugs are heavily reliant on basic research funded by the taxpayer and conducted by scientists working for universities or nonprofit research centers.” In his estimation, the R&D costs of major pharmaceutical companies are vastly overplayed, and the total cost to bring a drug to market is much lower: $60-90 million. Anything after that, he says, is profit.

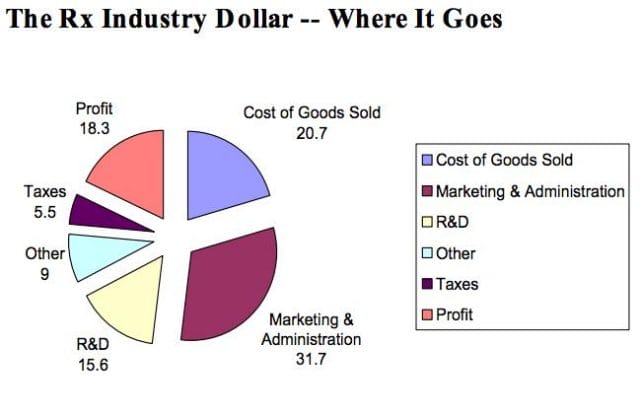

A 2008 study published in PLOS Medicine also claims this cost is around $80-90 million. They found that while pharmaceutical companies claim high R&D costs, marketing and promotion costs for a drug — which have nothing to do with innovation — can be twice as much (see below).

Source: Merrill Goozner

Dr. Hagop Kantarjian received research grants from a number of these pharma giants — Pfizer, Novartis, ARIAD — yet claimed in an extensive research report that drug prices were no longer sustainable. He admits that incentives are important, and that companies discovering life-saving drugs should benefit from healthy revenues. Dr. Kantarjian says pharma companies set prices based on market demand: “They start with the price for the more recent similar drug on the market and price the new one within 10-20% (usually higher).” One cancer drug, Imantinib, seems to have followed this model: at the time it was released, its competitor, Interferon, was on the market for $2,000/month; it was released at a price point of $2,200/month.

Considering all of this, Dr. Druker, one of the physicians who spoke out against Zaltrap, poses a pertinent question: “When do you cross the line from essential profits to profiteering?”

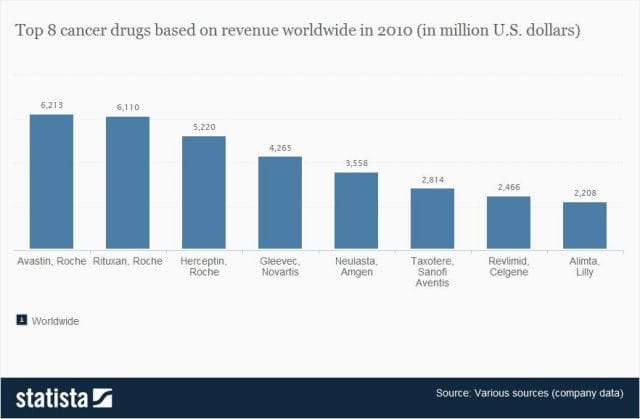

Even assuming each cancer drug costs $1 billion to produce (the very upper end of estimates endorsed by the companies themselves), many drugs seem to make out exorbitantly well. Gleevec, a leukemia drug, had sales of $4.7 billion in 2012 alone; Genentech’s lymphoma crown jewel, Rituxan, nets them $3 billion annually, and enjoyed a 9% growth in sales last year; Avastin, another Genentech drug, brings in $2.66 billion per annum.

Source: Statista

Patented Drugs vs. Generic Drugs: The Great Divide

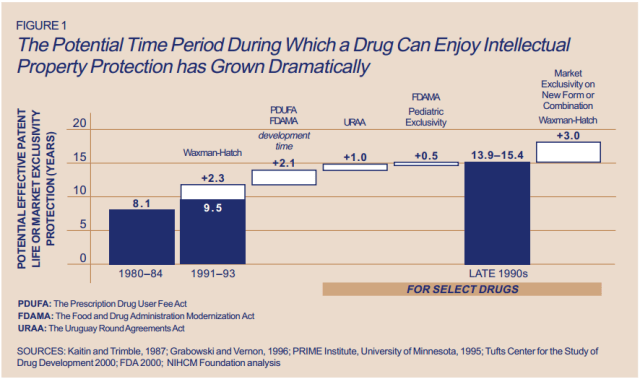

There’s another side of the story with cancer drug pricing, and it comes in the form of a lengthy, complex patent law. A University of Maryland Law report explains: “A patent provides the inventor with a means to capture the returns to his invention through exclusive rights on its practice for 20 years from date of filing.” The current patent system, stemming from 1984’s “Hatch-Waxman Act,” has dual policy goals: “providing incentives for inventors to invent, and encouraging inventors to disclose technical information.” Since the early 1980’s, patent life for cancer drugs has increased dramatically (see below).

Source: ThinkProgress

A patent is usually filed by pharmaceutical company during the clinical trials; this translates to 8-10 years of exclusive rights by the time a drug hits the market for cancer patients. While the patents “provide incentives for inventors,” they also provide monetary incentives for the executives: many argue these patents allow big pharma companies to monopolize on new drugs and raise prices. While “technical information” is often revealed, approaches are not, and new advancements are rarely shared between companies. According to the report, patents also raise the costs of non-patent holders wishing to use and spread new ideas — by an “estimated 40% in the pharma sector.”

When these patents expire, a floodgate of generic drugs enter the market, driving down prices. Last year, for example, Pfizer reported a $1.8 billion, or 33%, loss due to one of their drug’s rights expiring.

This is called the “patent cliff,” and since 2006, brand-name cancer drugs have lost $60 billion off its edge; by 2015, this figure is projected to rise to $160 billion. Josh Bloom, of the American Council on Science and Health, says that patents are often demonized in the drug debate, and many don’t recognize that the money they generate encourages innovation.

A lack of innovation and absence of monopoly is what makes generic prices so much cheaper: they don’t have the overhead that brand-name drugs do. As we’ve mentioned, patented drugs require a heavy initial investment (research, development, clinical trials); generic drugs only have to pay for production, and can afford to set dramatically lower prices. These lower prices are, in part, why generic drugs account for 85% of all cancer drugs dispensed in the U.S.

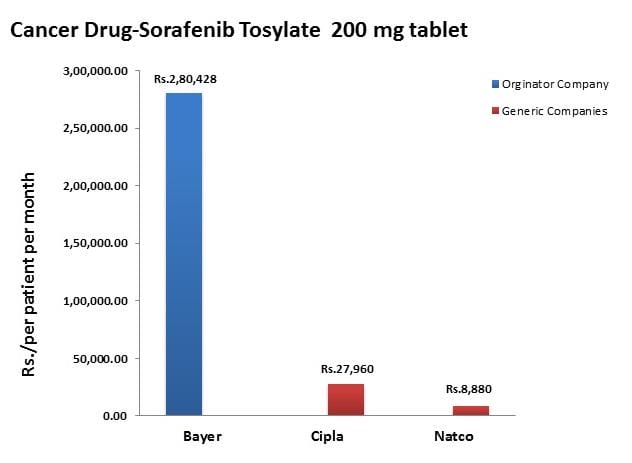

To understand the relation between generic and patent drugs, let’s turn to India, where most of the world’s cheap, generic drugs are produced. Over several years, India has been taking advantage of the fact that “a compulsory license may be granted if an invention is not available to the public at a ‘reasonably affordable price.’” In 2012, the country used this rule to win generic access of a cancer drug manufactured by Bayer, a major pharmaceutical company. Before India protested, the drug, Sorafenib, sold for 280,000 rupees ($5,600) per month; now, it is available for 8,800 ($176) per month, a little more than 3% of the drug’s original cost (see below).

Last year, India did this again with leukemia drug, Gleevec. Previously sold for $70,000 per year, Gleevac was produced in generic form and offered for $2,500 per year. With extra care options and coverage reductions, this made the drug infinitely more reachable for the two-thirds of India’s population that survives on $2 per day.

Source: InfoJustice

A Final Note

What we’ve touched on is only a small facet of the issues faced by patients. For one, there is a massive disparity in cancer care, and it’s not as simple as those who have decent health coverage and those who don’t. But another way to understand the cost of cancer drugs is to look at the wide range in price patients pay for them.

For the past two years, my father has been on repetitive cycles of Revlimid, a drug used to treat multiple myeloma patients. He contributes a co-payment of $30 per month for 28 pills.On a cancer forum, users openly discuss what they pay each month for Revlimid. One insured user reveals he pays a lot more than my father:

“My insurance covered Revlimid, but because it was a brand drug I had to pay the 40% co-pay, $2,400 a month. I have had to fight since April to: 1. Get this drug while my multiple myeloma is spinning out of control, and 2. Find a way to get on Revlimid because nothing else was working. The fight was enough to take me down.”

Another Revlimid user writes that his Humana individual health insurance plan does him “essentially no good:” he co-pays $4,141.74 for an 84-day supply.

Yet others state they pay “merely $10,” or “just $18 per 28 pills” for their co-payment of the same drug. Dr. Bruce Roth, a cancer specialist at the University of Washington, says he’s had “one patient pay $1.50 copay per month, and another pay $5,943” for the same drug.

All considered, cancer drugs are a highly nuanced issue. Medication prices have doubled, but so have drug submissions to the FDA, 95% of which will fail. Patents have secured greater profits for pharmaceutical companies, but have also encouraged innovation.

Dr. Jennifer L. Malin, a Los Angeles-based oncologist, leaves us with a consideration:

“We have a choice: do we use science to help us reach consensus on what we are willing to pay for new therapies and innovation, or do we leave individual patients to wrestle with the skyrocketing cost of cancer treatment determined by their ability to pay?”

There is no simple answer to her question. If prices were lower and patent rules were relaxed, it is quite possible that new life-saving drugs would never come to the market. But at the same time, the prices of existing drugs are rising at an alarming rate and people are willing to pay the price to live. There are very few market forces that suppress the price of cancer drugs and this has unnerving implications.

This post was written by Zachary Crockett. Follow him on Twitter here, or Google Plus here.