This post is from LendUp, a Priceonomics Data Studio customer. Does your company have interesting data? Become a Priceonomics customer.

***

With unemployment at a record high and the CARES Act expiring without additional funding, a record number of Americans are experiencing financial difficulties related to the Coronavirus pandemic.

At LendUp, we provide loans to people to cover unexpected expenses and when they need the money fast. These types of loans are often called payday loans, and they’re typically the only type of loan available to Americans with lower incomes.

Because of our years of underwriting loans and working with our customers, we know a lot about reasons why lower-income Americans need to get these kinds of loans. In this analysis, we’ll review the data on the reasons why Americans turn to payday loans and how it varies by age, income and geographic location.

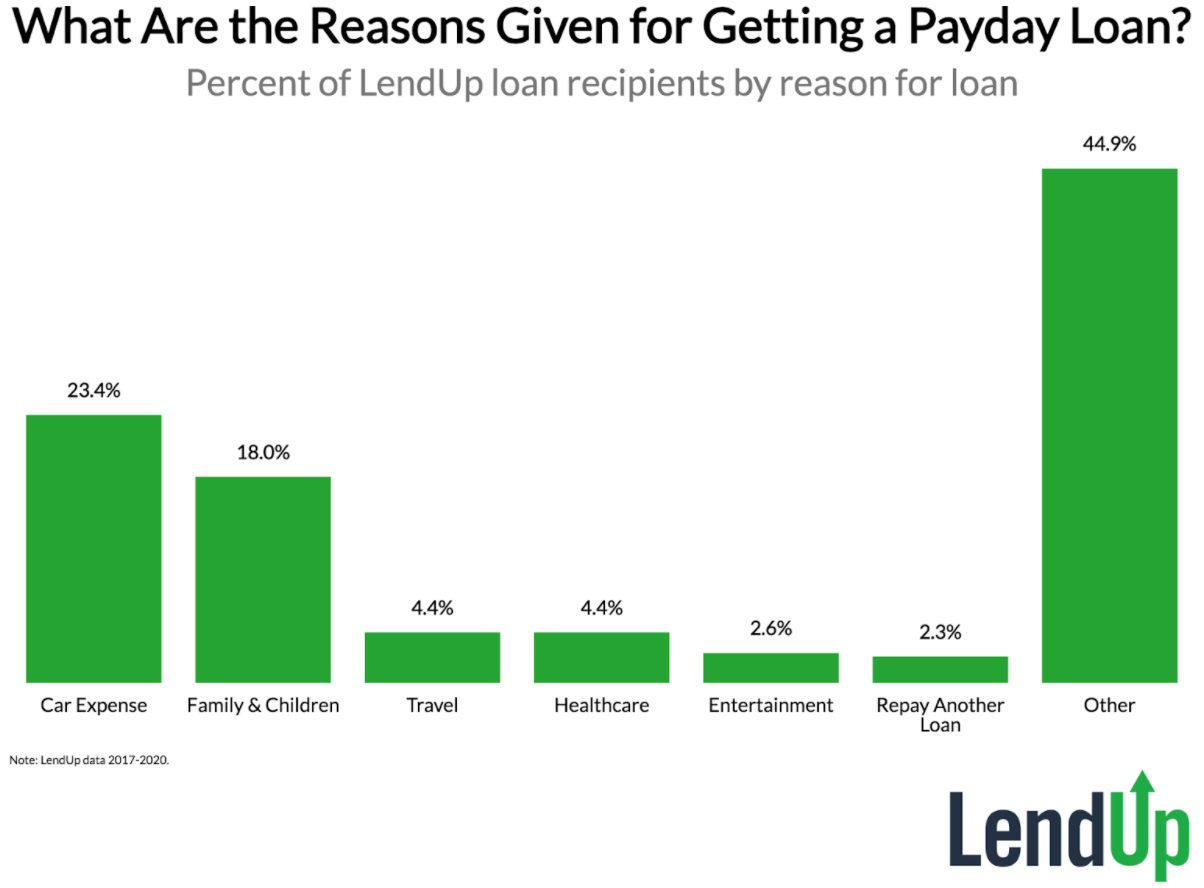

We found that for the most part Americans use payday loans for essential expenses rather than entertainment or paying back other debt. With many Americans financially struggling because of the pandemic and the expiration of government stimulus, one might expect that this struggle to pay expenses may become more intense. As part of our loan application process, we ask borrowers to state the reason they are seeking a loan. For this analysis, we reviewed loans from 2017 to 2020 to see the most common reasons. The chart below shows the most common reasons given, split by percentage of LendUp loan recipients:

As part of our loan application process, we ask borrowers to state the reason they are seeking a loan. For this analysis, we reviewed loans from 2017 to 2020 to see the most common reasons. The chart below shows the most common reasons given, split by percentage of LendUp loan recipients:

Outside of the catchall bucket of “Other”, the most common reason for getting a payday loan is to cover car expenses. For most Americans, a car is essential for getting to work and unexpected car troubles can jeopardize one’s employment as well as disrupt everyday life. After that, family & child-related expenses is the second most common reason for a payday loan.

More discretionary expenses like travel and entertainment make up just 6.6% of payday loans combined. Just 2.3% of payday loans are used to repay other loans, a practice that can leave borrowers with revolving debt that can be difficult to escape. Healthcare expenses make up 4.4% of payday loans (please note that in our survey methodology of loan recipients healthcare can also include veterinary expenses).

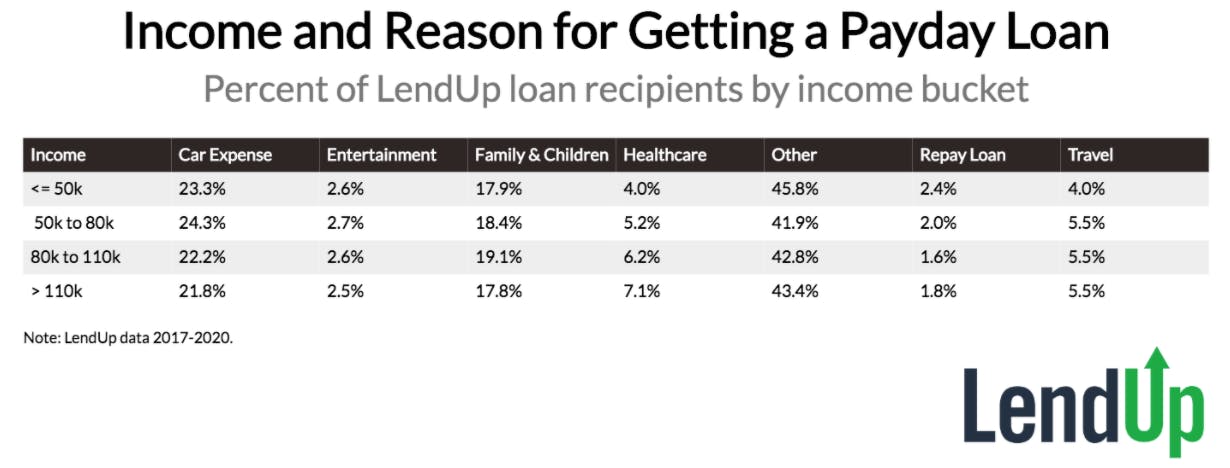

How do the reasons for getting a payday loan vary by one’s income? The chart below shows the percentage of loans by reason for each income group of LendUp loan recipients:

Higher-income recipients (earning over $110K per year) are more likely to get loans for healthcare expenses, but least likely for car expenses. Lower-income (earning less than $50K per year) recipients are most likely to get loans for repaying another loan and least likely to use a loan for healthcare expenses. Across all income groups, the use of payday loans for discretionary expenses is very low and the lowest income group is the least likely to use a payday loan for travel.

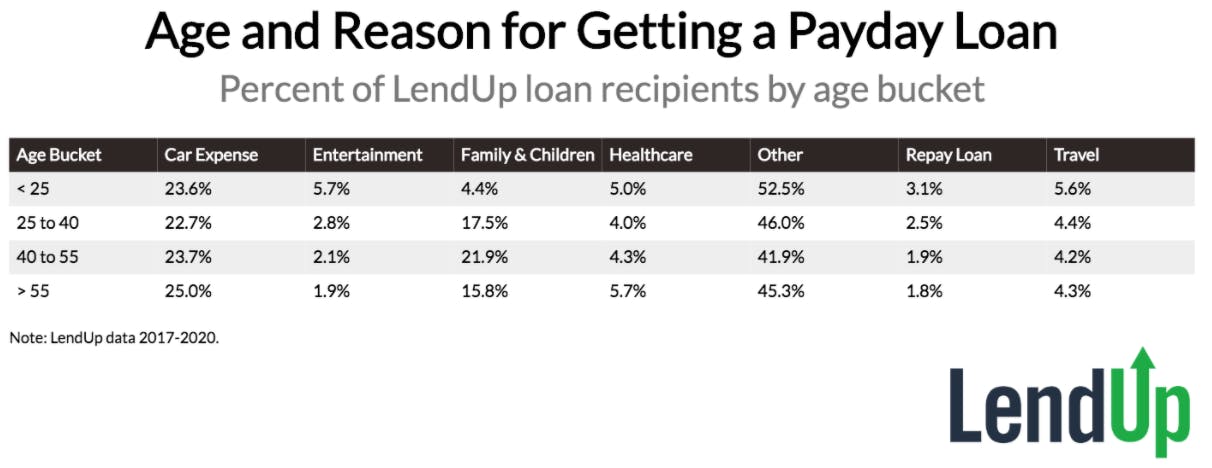

Next, let’s look how the reason for getting a payday loan varies by age. The following chart shows percentage of payday loans chosen by reason for each age cohort:

Young people (under age 25) are three times more likely than older people (age 55+) to use a payday loan for entertainment. Young people are also much more likely to use payday loans for travel or repaying other loans. Not surprisingly, those in the middle age cohorts are most likely to spend payday loans on expenses related to children and family. Older payday loan recipients are most likely to have to use the funds for healthcare-related expenses or car troubles.

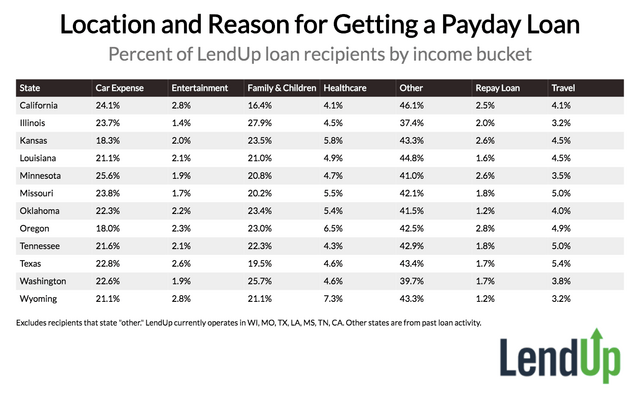

Lastly, is there any geographical difference in the uses of payday loans? The final chart shows the breakdown of loan reason in the thirteen states LendUp has distributed loans.

Minnesota borrowers are most likely to use a payday loan for car expenses. California and Wyoming are most likely to use loans for entertainment. Illinois recipients are most likely to use the funds for family and child-related expenses. Wyoming residents are most likely to need a payday loan for healthcare. Oregon borrowers are most likely to use payday loans to repay other loans and Texas borrowers are most likely to use payday loans for travel. With unprecedented economic uncertainty, many Americans have lost their jobs and still need to pay their bills and unexpected expenses. In this analysis, we’ve shown that by and large, most payday loan recipients use the funds for essential expenses, though younger recipients are most likely to use the debt for things like travel, entertainment or servicing other loans. For the most part, however, people get payday loans to cover expenses that need to be paid urgently.

With unprecedented economic uncertainty, many Americans have lost their jobs and still need to pay their bills and unexpected expenses. In this analysis, we’ve shown that by and large, most payday loan recipients use the funds for essential expenses, though younger recipients are most likely to use the debt for things like travel, entertainment or servicing other loans. For the most part, however, people get payday loans to cover expenses that need to be paid urgently.

***

Note: If you’re a company that wants to work with Priceonomics to turn your data into great stories, learn more about the Priceonomics Data Studio.